Why Invest in

Thai Real Estate?

Understanding the Landscape Before You Invest

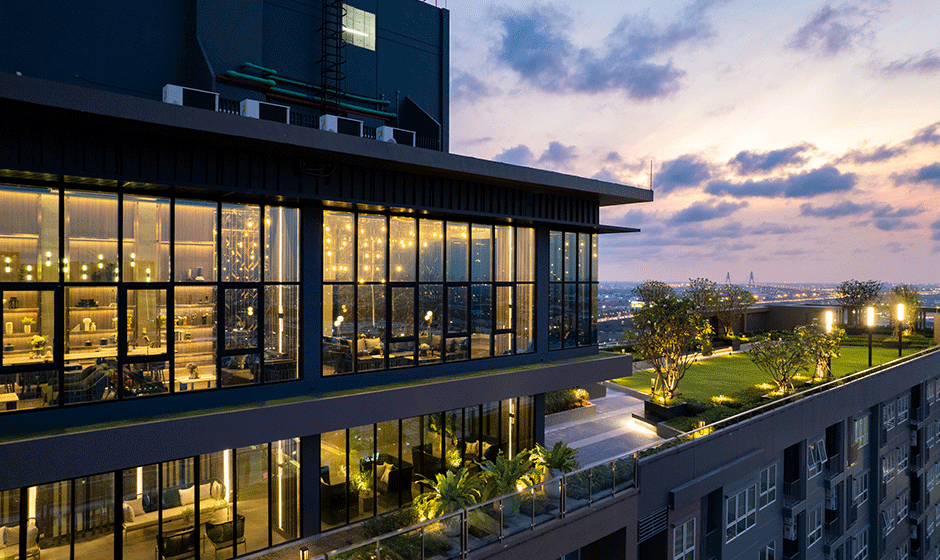

Strategic Location. Strong Demand. Long-Term Value.

Thailand has emerged as one of Southeast Asia’s most attractive destinations for property investment. From vibrant metropolitan centers to tranquil beachfront towns, the country offers a diverse range of real estate opportunities for capital growth, rental income, and lifestyle benefits.

Key Reasons Investors Choose Thai Real Estate

✅ Strategic Geographic Location

Situated at the heart of ASEAN, Thailand serves as a regional hub connecting major economies such as China, Singapore, and Vietnam. With continued infrastructure development, high-speed rail, deep-sea ports, and upgraded airports, the country is strengthening its role as a gateway for trade, tourism, and real estate development.

✅ Affordable Entry Point Compared to Global Markets

Compared to Hong Kong, Singapore, or Tokyo, Thailand offers relatively lower property prices, making it a highly accessible market for international investors. Prime city condos, resort villas, and income-generating assets remain competitively priced with attractive yields.

✅ High Rental Demand and Tourism Resilience

Thailand remains one of the world’s top tourist destinations, creating constant demand for short-term and long-term rentals. Cities like Bangkok, Chiang Mai, Samui and Phuket attract digital nomads, retirees, and business travelers fueling demand for condominiums, serviced apartments, and Airbnb-style units.

✅ Condominium Ownership for Foreigners

Unlike land ownership, foreigners may legally own freehold condominium units under the Condominium Act, up to 49% of the building’s sellable area. This offers a secure and straightforward channel to hold property in personal name with full ownership rights.

✅ Growing Infrastructure and Government Initiatives

Major government projects like the Eastern Economic Corridor (EEC), mass transit expansions in Bangkok, and smart city developments are transforming previously undervalued areas into property hotspots.

✅ Diversification and Lifestyle Benefits

Investors not only gain exposure to an emerging economy but also enjoy lifestyle benefits second homes, retirement residences, or holiday properties in iconic destinations like Bangkok, Pattaya, Phuket, Samui, Krabi, and Hua Hin.