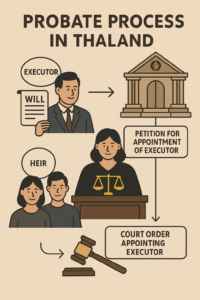

The Process of Filing a Probate Application in the Thai Court

Step-by-Step Guide to Estate Administrator Appointment Under Thai Law

Filing a probate application in Thailand is a formal legal procedure that requires court approval before anyone can be legally authorized to manage a deceased person’s estate. Whether the deceased left a will or not, the process is governed by the Civil Procedure Code and the Civil and Commercial Code of Thailand (Sections 1711–1754).

Below is a clear overview of the process to help you or your family understand what to expect and how our law firm can assist at each stage.

Step 1: Initial Consultation & Case Assessment

Our legal team begins by:

- Assessing the nature of the estate (with or without a will)

- Identifying the lawful heirs or beneficiaries

- Determining your legal standing to act as petitioner

- Confirming which Thai court has jurisdiction over the matter (typically where the deceased last had domicile)

We will also review all relevant documents and recommend any additional evidence that may be needed

Step 2: Preparation of Legal Documents

We will prepare and organize:

- The formal probate petition (คำร้องขอเป็นผู้จัดการมรดก)

- An inventory of assets, list of heirs, and applicable evidence

- Supporting documents such as identification, death certificates, and will (if applicable)

- Letters of consent from other heirs (if needed)

- Power of attorney, if we are representing you in court

If documents are in a foreign language, we will arrange certified Thai translations and legalization as required by the court.

Step 3: Filing the Petition with the Court

We will complete the Petition and then submit the petition to the appropriate Thai Provincial or Civil Court.

Upon acceptance, the court will schedule a hearing date (typically within 30 – 60 days), and may issue formal summons to All known heirs or beneficiaries. If written consent from all lawful heirs has been submitted to the court, it is not necessary to formally serve pleadings or summon court documents on those heirs.

Step 4: Notification and Publication

In accordance with Thai legal procedures, the court will:

- Publish notice of the petition in a public newspaper (At present, Thai courts commonly publish official announcements through electronic media – Court of Justice website)

- Require service of summons on all relevant parties (if the petitioner cannot provide consent letters from all heirs)

- Allow time for any objections or claims to be filed by other interested individuals

This step ensures transparency and the opportunity for opposing parties (if any) to contest the petition.

Step 5: Probate Hearing Before the Court

On the assigned court date:

- The petitioner or legal representative appears before the judge

- The court reviews all documents and verifies the legitimacy of the claim

- If the case is straightforward and unopposed, the court typically approves the petition without extensive litigation

If objections are raised, the matter may proceed to evidentiary hearings or mediation.

Rest assured, we will accompany you to all scheduled court hearings and proceedings. Our team will also assist you in preparing and practicing your statements in advance to ensure you are confident and well-prepared during your time before the court.

Step 6: Issuance of Court Order Appointing Estate Administrator

If the court is satisfied with the evidence, it will issue an order appointing the estate administrator. This legal appointment gives the administrator full authority to:

- Collect and manage all the estate assets

- Distribute the estate according to the will or laws

There is no need to worry. Approximately 30 to 45 days after the court hearing, our firm will coordinate with court officers to obtain certified copies of the court order and final decree on your behalf. Once issued, we will deliver the original court documents directly to you. The appointed estate administrator can then use these official documents, along with proper identification, to proceed with matters at banks, land offices, and other relevant authorities.

Furthermore, should you require the documents to be translated into English and notarized, we are pleased to arrange this service for you. Upon completion, we can securely courier the documents to your country, simply let us know your request.

Let KTP Legal Advisory Handle the Complexity for You

Thai probate law can be intricate, especially when foreign heirs or international documents are involved. At KTP Legal Advisory, we provide:

- Full-service probate petition filing

- Court representation for Thai and foreign clients

- Translation, certification, and notarization support

- Transparent timelines and fixed-fee options

We ensure your probate process is smooth, legally compliant, and handled with the professionalism your family deserves.